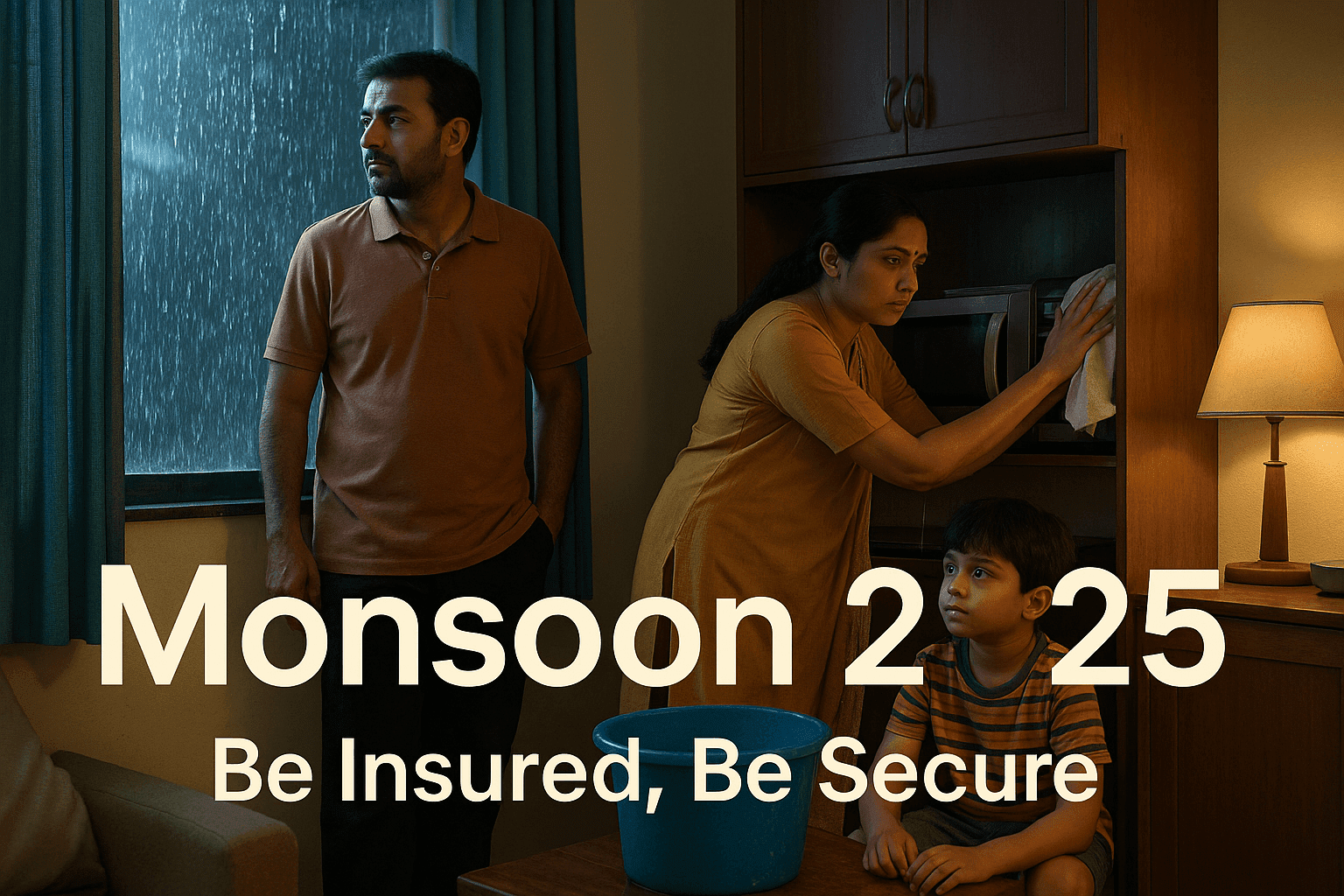

🌧️ Monsoon 2025: Are you ready?

Monsoon weather is definitely romantic, but it also brings many risks and damages – like flooded roads, car engine failure, water entering the house, and seasonal diseases like dengue, malaria, infection etc. and accidents.

During the monsoon of 2024 itself, India suffered losses of ₹5,000+ crore. According to weather reports, the monsoon of 2025 is going to be even more intense.

Therefore, taking insurance for monsoon is not just an option, but a necessity. Let us get those essential general insurance plans which will give financial security to you and your family in this season and will also keep you worry free.

🚗 1. Motor Insurance – for both Car and Bike

✅ Monsoon Risk:

Flooded roads and water ingress can cause the engine to seize. And this damage is not covered in basic third-party insurance or normal comprehensive insurance

🚘 Essential Add-ons:

Engine Protection Cover – Flooding provides a claim for engine damage.

Zero Depreciation Cover – Full claim without value of parts deduction.

Consumables Cover – Its presence with Zero Dep can be an icing on the cake. In case of damage to parts, claim for some consumables like nuts, bolts, lubricant, packings, seals is also available along with it, otherwise even without Zero Dep Cover, the customer has to pay for it.

Roadside Assistance (RSA) – Help is available in case of car stopping, like in case of breakdown, repairing the vehicle at the spot or towing it to the nearest service centre.

Return to Invoice Cover – In case of total damage to the car, the full value is received.

🔝 Best Insurers:

ICICI Lombard

Tata AIG

HDFC Ergo

Digit Motor Insurance

🧐 It is very important to compare the premium and covers of the companies and especially the Cashless Tie-ups of the companies to the required Service Centres.

💡 Tip: If you live in flood-prone areas like Mumbai, Chennai, Assam, or Kolkata, then definitely take Engine Protection Cover.

🏠 2. Home Insurance – Keep your house safe

✅ Risk in Monsoon:

Water leakage and seepage

Short circuits

Damaged furniture, appliances

Falling of walls and ceiling

🏡 Best Home Insurance Plans:

Bajaj Allianz My Home

HDFC Ergo Home Shield

Digit Home Insurance

Oriental Insurance

Company

📦 Necessary Add-Ons:

Flood Rider

Earthquake Cover

Home Contents Insurance (TV, fridge, AC, Furniture & Fixtures etc.)

👨👩👧👦 Are you a tenant?

Just get contents insurance with all the required covers. It is cheap and safe too

💊 3. Health Insurance – Avoid diseases in Monsoon

⚠️ Common Diseases:

Dengue

Malaria

Typhoid

Leptospirosis

Viral fever

Regular health plans do not cover OPD or day-care, so taking extra coverage for monsoon is a smart choice.

🏥 Recommended Health Plans

Star Health Comprehensive

Care Health with OPD Benefit

Niva Bupa ReAssure 2.0

➕ Add-On Riders:

OPD Cover

Hospital Daily Cash

Critical Illness Add-on

💡 Tip: Nowadays OPD has become quite expensive. Taking an OPD rider will be useful for the monsoon season.

🛡️ 4. Personal Accident Insurance – Monsoon Slips & Accidents Cover

Slipping during rain, falling of trees, or road accidents are common. Personal Accident Insurance protects you from all these.

🔝 Best PA Plans:

Tata AIG Personal Accident

Bajaj Allianz Individual Accident

Aditya Birla Activ Secure PA

Oriental Insurance Company

Coverage includes:

Accidental death

Permanent disability

Temporary disability

Hospital cash benefit

Accidental Medical Cover with a very small loading of premium.

📊 How to Choose an Insurance Plan?

Why are the criteria important?

Claim Settlement Ratio should be 90%+

Add-on Coverage for Monsoon-specific risks

Premium Affordability

Budget-friendly with max benefits

Customer Service should be 24×7 support

Renewal Process Easy online renewal options

❓ FAQs – Answers to your questions

Q1. Is flood damage covered in normal motor insurance?

❌ No! To cover flood or water damage, you have to take Engine Protection Add-On.

Q2. Is damage to the house due to rain covered?

✅ Yes, but only when your policy has Flood and Natural Calamity Rider.

Q3. Is dengue treatment covered under health insurance?

✅ If your plan has OPD or day-care coverage then definitely.

Q4. Will it be late to take insurance in monsoon?

✅If the damage has already happened, then it will not be covered. It is best to take insurance beforehand.

Q5. I am a tenant, can I get home insurance?

✅ Yes! Home contents insurance will protect your belongings.

🔚 Conclusion – Insurance is a necessity, not just an option

Monsoon comes every year, but every time with new risks. If you use insurance plans correctly to secure your car, home, and health, you can save lakhs of rupees.

🚨 Don’t wait for damage to happen – secure your life, health & assets before the rains hit.

👉 Get insured before the 2025 monsoon season and enjoy peace of mind.

Contact me for any type of Insurance related and Mutual Fund related query by :